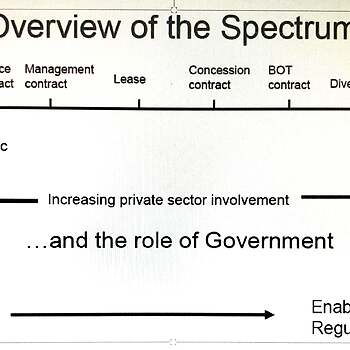

The spectrum of PPPs

The two most defining and inter-related characteristics are the investing partner and the duration of the PPP contract. Moving from left to right in the above PPP Spectrum figure, from Service Contract to Lease, it is the public party that finances the investment and the contract duration is relatively short (up to say 10 years). From Concession onwards, the private party invests and the duration is longer (up to 30 years). The better-known extremes on either side of the spectrum are a service contract and a concession contract, with very little, respectively nearly all responsibilities and risks on the private party.

In the case of a service contract, the private party provides a duly specified good (e.g. pipes, water meters, an entire treatment plant) or a service (installation of equipment, or consultancy) to the public services provider, against a set price. Here, the private party is bound to deliver as per the terms and conditions of the concerned contract.

In the case of a concession contract, the private party is responsible for all investments and the operation and maintenance of an entire water and/or sanitation system. Concessions have a long duration, say 30 years, in order to allow the private party to recoup its investments from the tariff it collects from the customers. After the concessionary period, all assets revert to the public party.

BOT and comparable contracts (such as BOO, BOOT, BOLT, LDO, ROT, DBFOT) are often arranged where one specific investment (mostly a water or wastewater treatment plant) needs to be build or rehabilitated. Bids may be invited for a duly specified plant (capacity, quality of drinking water/effluent, etc.) and the winning party is the one that will charge the least cost per m3 of water or wastewater treated. The duration of these build-operate-transfer contracts is comparable to that of concessions.

Divestiture is a form of PPP that is only practiced in a few countries worldwide, including England and Wales; in this type of PPP, the public owner sells all assets of the utility to a private party that then becomes responsible for all aspects of services provision in the service area. In the case of divestiture, an independent Regulator needs to safeguard the interests of the customers as the private party operates a monopoly.

The Experience with PPPs

Public Private Partnerships have been around in this sector since the start of drinking water supply in the 19th Century, but were coined and promoted as such starting in the nineteen eighties. The simpler type of PPP, the service contract is being widely applied and has allowed water utilities to do away with operational activities that are not part of their core business, i.e. water production, distribution and sales. Apart from the Capex related consultancy and construction that have since long been arranged through service contracts, now the non-core, Opex related activities such as catering, printing, vehicle ownership and maintenance, and other activities were contracted to private parties, often after a competitive bidding process. Together with computerization and automation (see section on ……), this type of PPP allowed utilities to reduce staff numbers and personnel costs and increase staff productivity (number of staff/1000 connections).

The more advanced types of PPP where the services are offered by a private party, in particular the concession contracts have experienced successes and failures. Since 1990, more than 260 contracts have been awarded to private operators for the management of urban water and sanitation utilities in the developing world, but even then, only about 7 percent of the urban population in the developing world is served by private operators. From the onset, these PPP initiatives have been controversial, particularly after a series of highly publicized contract terminations raised doubts about the suitability of the approach for developing countries. The PPP failures were related to dissatisfaction with the performance, to the unclear or incorrect allocation of risks and to ideological and political resistance against the PPP concept. This led to conflicts and even to the breaking up of the contract, or a return to public operation after the expiry of the contract.

In 2007, a World Bank study analyzed performance data from more than 65 large water PPP projects that had been in place for a number of years. The sample represents close to half of the urban population that was served by private water operators some time between 1990 and 2007. The outcome shows that among the active and sufficiently mature contracts (excluding recent projects), those who were ‘clearly successful’ served a combined population of 50 million people, i.e. just over 1/3rd of a combined total population of 145 million people. The success cases include Dakar (Senegal), Cartagena (Colombia), Guyaquil (Ecuador). Mixed results cover 20 million people and include West Manila (Philippines), Jakarta (Indonesia) and Maputo (Mozambique). Terminated contracts (25 million people) included those for Dar es Salaam (Tanzania), Cochabamba and La Paz-El Alto (Bolivia), Buenos Aires and Buenos Aires province (Argentina). Among those who were not renewed (20 million people) were Johannesburg (South Africa) and Gaza City (Palestinian territories), despite them being assessed as good performance by the contracting governments.

Due to the disappointing experiences that were well-publicized, many governments hesitate to embrace the more advanced PPP types, as a result of which the market is growing only slowly. Even then, the number of private operators in this market has much outgrown the original group of European companies and now includes a wide array of regional and local private operators some of which now also operate globally. The European private operators that stood at the cradle of this type of contracts have since withdrawn from most developing countries and focus their attention instead on the more mature European and North American markets.

References:

World Bank (2015), ppp.worldbank.org/public-private-partnership/case-studies-and-lessons-learned-water

Marin, P. (2009), Public-Private Partnerships for urban water utilities – a review of experiences. World Bank and PPIF.