Technocratic approach to Investments

The approach to water supply development was almost exclusively technocratic and field work remained limited to geographical and hydrological surveys. Socio-economic surveys were a rarity. Inputs on urban development and projected populations for the sake of planning water supply outlays were obtained from physical planning organisations that otherwise did not play an active role in developing the water system. Due to staffing limitations in the water sector (for example: only in 1975 was a first group of students from Swaziland sent for engineering training to Canada), the investment initiatives were typically led by national agencies and in the eary days, key positions were often held by expatriates that had stayed on after decolonisation or were posted there as experts, quite often as one component of a bilateral or multilateral capital investments programme.

The practise where water development is a central or regional function prevails to this day in quite many countries. Operation of the service was organized locally, often by establishing water departments within the municipal administration. Both the national organisations involved in system development and the local municipal water departments charged with the operation of water systems were primarily staffed and often headed by engineers and technicians. By comparison, the number of financial and commercial staff was very limited and their focus was mostly on administration and accounting. There was actually very little focus on balancing revenues and expenditure as the singular focus was on the provision and expansion of water services. During this period water was mostly seen as a social good and priced accordingly, as a result of which water operators either ran up debt or received subsidies. The economic pricing of water was till decades away (see 'Water as an Economic Good').

Staffing limitations also led to the development of national guidelines including standardized approaches, design manuals and standard designs for system components. Although they served their purpose well, later on these national guidelines hindered the development and application of new technologies and approaches.

Public funding of Capital Investments

International initiatives in support of economic development and infrastructure investments included the establishment of the World Bank and the International Monetary Fund, in 1944. The IMF would provide temporary financial assistance to countries encountering difficulties with their balance of payments. The World Bank would lend money to war-ravaged and impoverished countries for reconstruction and development projects. A host of regional international financing institutions followed the World Bank initiative, including among others the Interamerican Development Bank (1959), the African Development Bank (1964), the Asian Development Bank (1966), the Islamic Development Bank in 1973, and the European Bank for Reconstruction and Development (EBRD) with a focus on Eastern Europe and Central Asia in 1991. In addition, bilateral development banks were set up in countries like The Netherlands (FMO), Germany (DEG), France (AFD) and the UK (CDC), with the aim to finance projects in emerging economies.

Together, these financing institutions have enabled infrastructure investments on a large scale in almost every country and sector in an era where, unlike nowadays, most countries’ own investment capacity was limited and where private capital was rarely if at all available. By way of example, since 1947, the World Bank has financed 12,000 infrastructure projects with lending commitments between US$ 10 and 60 billion per year.

However, with all these funding mechanisms in place, as early as the 1990s the demand for investment finance started to outstrip the availability of national and international public funds. The shortages of public funding became ever more evident when first the Millennium Development Goals (2000-2015) were proclaimed and later confirmed with the adoption of the Sustainable Development Goals (2015-2030).

Need for innovative financing

The commitment of UN member states to supply the entire population with safely managed water and sanitation services by 2030 (SDG #6) came with a need to assess and finance the necessary investments. Estimates of the financial requirements to provide these services amount to a staggering US$ 114 Billion per annum. The Financing for Development Conference in 2016 in Addis Abeba raised the question if public funding that had become the premier financier of capital investments in the water and sanitation sector, would be able to raise this amount, and if not, what part it could raise. Several countries reported that under a ‘business as usual’ scenario the conventional sources of investment funding (national budgets, DFIs and IFIs) could cover roughly half of the required amount and probably even less. In fact, national public resources available for water and sanitation showed little if any growth, and foreign public funding was diminishing rather than growing due to the de-prioritisation of development cooperation by several import bilateral donors (or a shift away from WASH) and the upward economic mobility of developing countries that disqualified them from getting grants and cheap loans.

The realisation that public funding would not be sufficient to achieve SDG 6 means either of two things: 1) the publicly funded ‘business as usual’ scenario will prevail, in which case the funding gap will not be addressed and SDG 6 will not be achieved; or 2) A very significant amount of private, i.e. commercial funding will somehow be mobilized to supplement public funding thus filling the funding gap and retaining the perspective of achieving SDG 6 . The choice has to be for the latter but in practise the mobilisation of commercial funding is materializing only very slowly.

Depending on the size of the investments and the nature of the borrower, there is a variety of options for the application of commercial funds: microfinance, vendor/supplier finance, commercial bank loans and bonds. Whatever the source, the concerned providers of private funds want to be guaranteed a fair return on their investments. In other words they would prefer to invest in creditworthy borrowers and/or want certain safeguards to be in place to offset their risks, be these political, regulatory, social, financial or otherwise.

Creditworthiness of the borrower, project size and the tenor of the loan are important parameters for a commercial financier. Creditworthiness is a sine qua non even if the loans are (partially) guaranteed. Commercial banks, in an effort to manage their risks, generally prefer short tenors (up to 5 years) and smaller projects (less than US$ 10 million). Institutional investors are in it for the long run and prefer larger projects and long tenors. They are actually the more logical lenders as the water and sanitation assets that are being created are capital intensive and have a long lifetime.

Blended finance

The concept of blended finance is to bring together funding from public and private sources, the idea being that in that way the cost to the borrowing entity would be less. This is based on the assumption that public funds have more favourable lending conditions that private funds and that bringing the two sources of funding together works out cheaper to the borrower. Experience to date is limited, but one early example is the Output Based Aid (OBA) program by the World Bank that is funded by bilateral donors. In Kenya, a US$ 10 million program was set up that benefitted a number of water services providers (WSPs) as follows. Projects were developed using grant money from the WB and were offered for financing to Kenyan commercial banks. The banks contracted with the WSPs for the entire investment amount (100%), the projects were implemented by contractors and after all investments were delivered and verified, the WB paid the WSP 60% of the investment in the form of a grant. Although initially the investment is fully commercially financed, the public funding kicks in after completion. For the utility this way of financing was quite attractive as the ‘blending’ here combines a 40% commercial loan with a 60% grant.

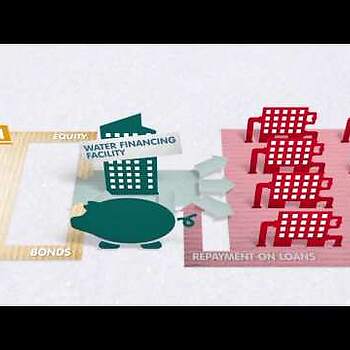

The Water Finance Facility

One Dutch initiative in innovative financing is the Water Financing Facility (WFF). This initiative by DGIS/IGG and the Cardano Development Foundation is about improving access to local capital markets. WFF’s objective is to regularly issue bonds in the local capital market to finance specific investments by creditworthy water and sanitation providers. WFF provides transaction support to the utilities and supports them in developing their investment projects. WFF is active in Kenya where a local unit, the Kenya Pooled Water Fund, has engaged with 14 water services providers. Eight projects have been developed and several more are in the pipeline. The first six projects with a joint value of US$ 20 million are expected to be financed by the local capital market in 2021.